- 9762967219

- Kathamandu, Nepal

- info@investyflux.com

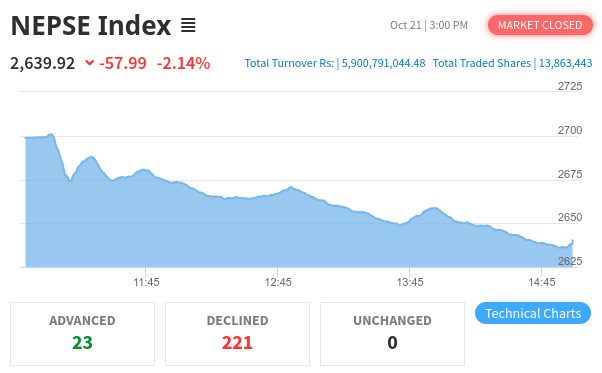

The NEPSE Index closed at 2,068.31 after experiencing a decline of 43.98 points, representing a decrease of 2.08%. The previous week’s closing was at 2,112.29, reflecting a gain of 1.66% from the week before. Considering the recent performance, it’s evident that the NEPSE Index has faced a significant drop in value.

The NEPSE market from June 16 to June 20, 2024, exhibited a blend of sector-specific growth, consistent market expansion, and investor confidence in sectors such as hydropower and finance. While the market experienced fluctuations, the overall trend indicates opportunities for growth in specific sectors, underlining the need for investors to consider various factors before making investment decisions.

This week’s market update underscores the dynamic nature of the NEPSE market and the need for investors to stay informed about sectoral performances, economic indicators, and potential risks to make well-informed investment decisions.

Copyright © 2025, Investyflux. | All rights reserved.

BACK TO TOP